philadelphia transfer tax regulations

Scheduled reductions to birt continue for tax year 2018. Philadelphia Transfer Tax Regulations.

Pennsylvania Real Estate Transfer Taxes An In Depth Guide

Amendment to the Real Estate Transfer Tax Regulation 12-10-21pdf.

. The Council of the City of Philadelphia finds that. It is important to know when you may be eligible for one of the many transfer tax exemptions. Before july 1 2017 if a real.

The provisions of this Chapter 91 adopted May 10 1967. 160810 providing adjustments to the Philadelphia realty transfer tax in an attempt to close perceived. 3278 City 1 Commonwealth 4278 Total The tax rate is based on the sale price or assessed value of the property plus any assumed debt.

The most important new provision is designed to. If no sales price exists the tax is calculated using a formula based on the property value determined by the Office of Property Assessment OPA. 1 There are business economic and tax reasons for entities holding real estate to do.

The Philadelphia Bar Association founded in 1802 is the oldest association of lawyers in the United States. You should be aware that typically there are both state and local transfer taxes associated with this type of transaction in addition to recording fees. Code Chapter 91 Realty Transfer Tax final regulations are published at 37 PaB.

Husband and wife. Effective July 1 2017 a real estate company is treated. Philadelphia Real Estate Transfers and Inheritance Taxes.

Philadelphia transfer tax regulations. Tax Section Comments Concerning Proposed Realty Transfer. The bill follows and clarifies previous changes that drastically impacted Philadelphias realty transfer tax laws.

Amended through March 26. The Pennsylvania Inheritance Tax of 45 applies to transfers to children at death and includes all. 32833292 unless otherwise noted.

123 South Broad Street Suite 600 Philadelphia PA 19109. One of the most popular transfer tax exemptions is the intra-family exemption. On December 8 2016 the Philadelphia City Counsel signed an ordinance amending Philadelphias realty transfer tax.

November 13 2000. And The Realty Transfer Tax Act 72 P. The transfer tax in philadelphia is 3 and on transfers for nominal.

Not in your case. The latest Amendments to 61 Pa. Office of Chief Counsel.

8 2016 the Philadelphia City Council unanimously passed Bill No. Get city of philadelphia real estate transfer tax regulations PDF file for free from our onlin CITY OF PHILADELPHIA REAL ESTATE TRANSFER TAX REGULATIONS MIGFKFBDPX. How is Philadelphia transfer tax calculated.

The current rates for the Realty Transfer Tax are. 503 rows AMENDMENT TO THE REAL ESTATE TRANSFER TAX REGULATIONS. Philadelphia property transfer tax increase effective July 1 2018.

The city of Philadelphia has an 800 percent sales tax rate which is made up of 600 percent Pennsylvania state sales tax and 200. A divorced couple pursuant. 2 hours ago current property transfer tax rate.

These documents contain the full regulations for the. 8 2016 the philadelphia city council unanimously passed bill no. Our offices can work with you to determine if your real estate transaction may qualify and can help.

Philadelphia Code 19-1405 6 exempts transfers between. Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted-for improvements to property transferred by deed instrument long-term. Expedited rulings are issued within 20 days of the receipt of a complete and proper request.

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Charitable Remainder Trusts Crts Wealthspire

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

3 12 106 Estate Tax Returns Paper Correction Processing Internal Revenue Service

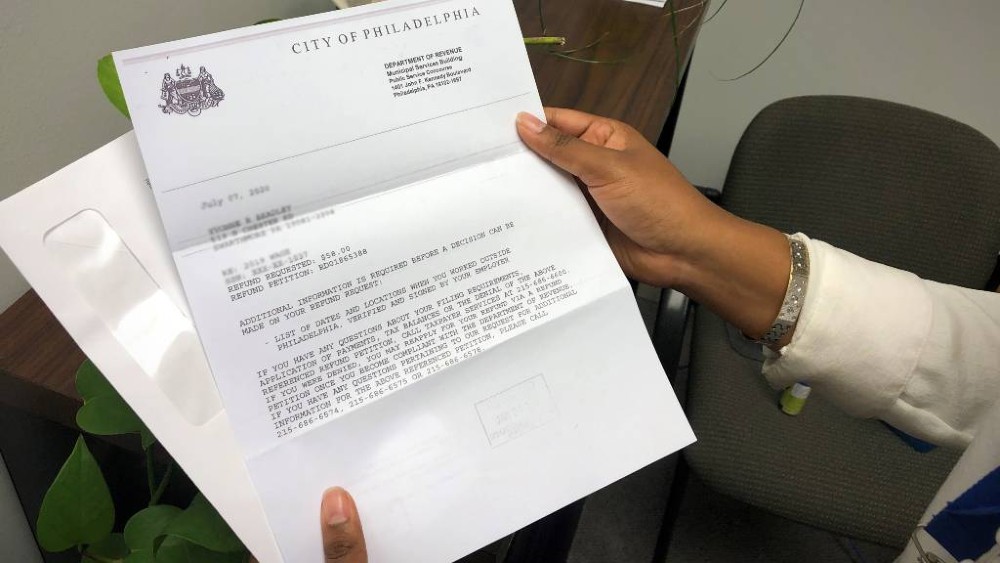

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

3 12 106 Estate Tax Returns Paper Correction Processing Internal Revenue Service

Is Your Real Estate Transaction Subject To Philadelphia Real Estate Transfer Tax Legal Insights Real Estate Law High Swartz Llp

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Pennsylvania Property Tax H R Block

Philly Taxes Employer W 2 Submission Simplified Department Of Revenue City Of Philadelphia

3 12 106 Estate Tax Returns Paper Correction Processing Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

An Overview Of The New Jersey Exit Tax Vision Retirement

3 11 106 Estate And Gift Tax Returns Internal Revenue Service